- August 22, 2023

Insurance in Superannuation – Cost of Default Insurance

Damian Thornley | Partner

August-2023

Since 2021 Azuria Partners have researched default insurance packages offered by some of the Australia’s largest public-offer superannuation funds.

We have recently updated our ongoing research, examining the following aspects of default insurance arrangements and how these are changing.

- Annual premium cost for default insurance cover, and

- Changes in underlying rates, revealing whether there is improvement in value or decrease in value for customers.

Before we examine the latest results in detail, I want to provide an overview of market factors that could be impacting on premium rate levels.

Anticipated macro premium rate trends 2021 -> ongoing

Considering recent changes in the insurance-in-superannuation market, we may expect some downwards pressure on premium rates due to the following cumulated effects.

- Removal of any Covid loadings that may have been introduced around 2020,

- Removal of any PYS related anti-selection claims experience. If this generated some temporarily elevated level of claims experience, then such loadings in the premium basis are generally being removed or reduced as the time lengthens from the original PYS implementation date, now 4-years old.

The downwards impact of these forces could be mitigated or even overwhelmed by forces pushing TPD premium rates higher due to.

- Expansion of the scope of full TPD benefits and therefore an increase in the estimated number of claim payments of the TPD benefit,

- volatility of TPD claims experience can be high in some cases, leading to potential deterioration of claims experience.

Annual cost of default insurance premium | August-2023 results

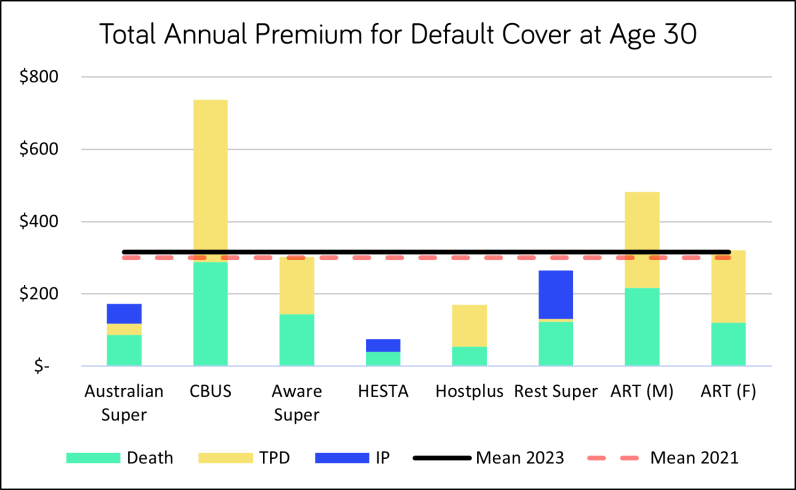

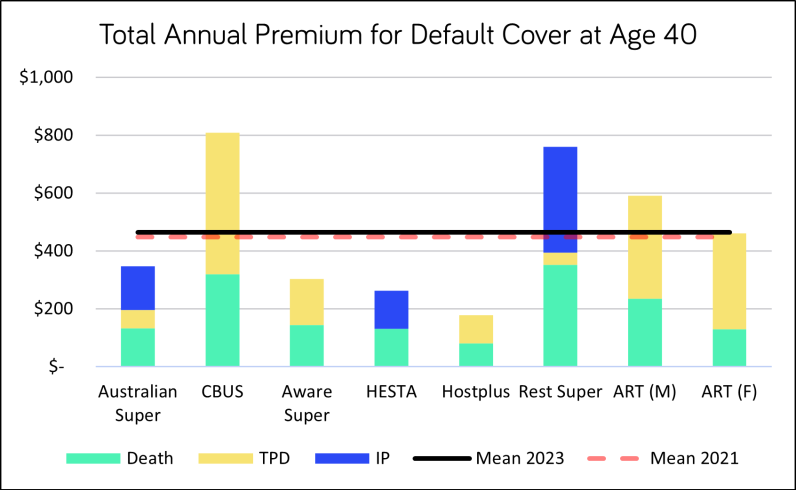

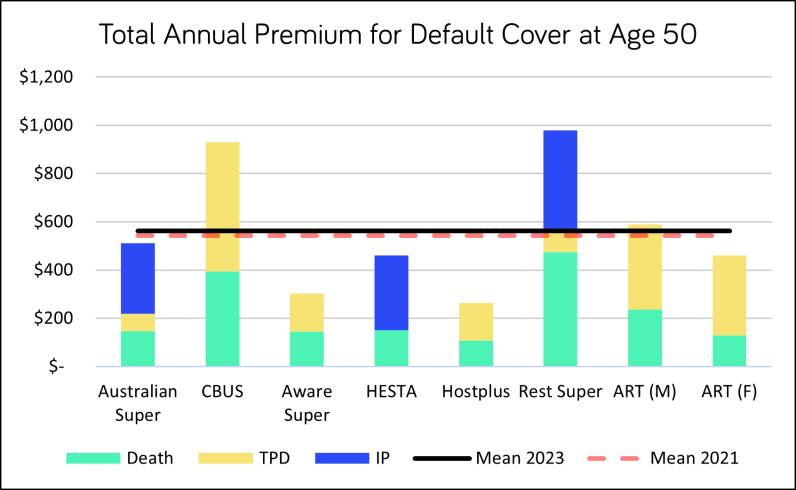

Mean default insurance premiums are between $300 to $600 per annum for ages 30-50. This is well within the recommended 1% of salary guidance for maximum insurance premiums. Minimal change observed since original survey in October-2021.

Underlying rates – Value to the customer | August-2023 results

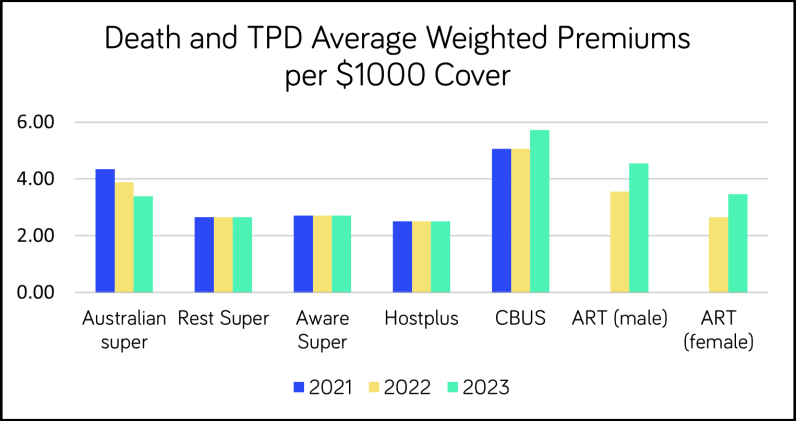

The table below shows the average weighted unit rate per $1,000 sum insured, applying consistent sum insured weights across all Funds.

- Three Funds have Death&TPD premium rate below $3 per $1,000 being Hostplus as the most competitive, then Rest Super and then Aware Super.

- AustralianSuper has become more competitive over both years, reducing by 22% since 2021.

- ART reflects the ex-Sunsuper industry fund design part of the Fund and has increased premiums by +28%.

Conclusion

Default annual insurance premiums continue to be stable within the range of $300 to $600 per annum for 30–50-year-old members.

Only one fund shows premium rate reductions (AustralianSuper) whilst two funds (Cbus and ex-Sunsuper) show premium rate increases.

Three out of the six Funds surveyed have not changed their underlying premium rate. This result is expected considering that the time series study period is still relatively short (just over 1.5 years) and therefore some Funds have not renewed their premium rate during this short period.

For any questions about this research, please feel free to contact Damian Thornley on 0402 803 900 or dthornley@azuria.com.au