- May 9, 2023

Insurance in Super – Default Premium Rate movements across Calendar Year 2022

Welcome to the Festive Season and as a year in wrap, Azuria Partners have provided a brief overview of movements in Insurance in Super premium rates across the previous 12-months.

Following Azuria Partners’ initial study of the top seven largest Australian Superannuation Funds published in October-2021, we have now studied premium rate changes across the last year, spanning from October-2021 through to November-2022.

Among the top seven largest Super Funds, insurance premiums have been observed to be broadly stable across the last 12-months.

- Cleaning and filtering data to remove errors and adjust for missing values.

- Reformatting data (e.g. converting date of birth from ‘Text’ type to ‘Date’ type).

- Linking multiple data sources with different information to create a single dataset.

- Creating new variables and fields (e.g. calculating ‘Age Next Birthday’ from Date of Birth).

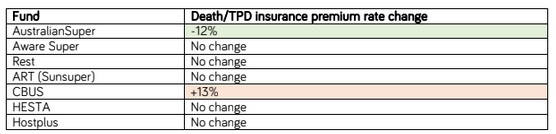

Death & TPD default insurance

Income Protection

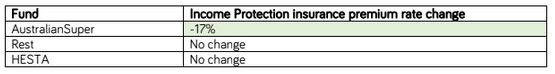

Three of the Funds we studied have income protection as a default insurance benefit.

AustralianSuper reduced their income protection premiums by 17% while the other Funds maintained neutral premium rate changes.

Chart 2: Income Protection premium rate changes from October-2021 to November-2022

Conclusion

We have observed stability in large Superannuation Fund insurance premium rates across the 2022 calendar year.

The low number of changes during the year may have been due to Superannuation Funds focusing on YFYS and cost efficiencies, where such initiatives have taken priority over reviewing insurance premiums.