- March 23, 2023

Article 20 of Prudential Standard SPS 250

Background

This discussion note examines article 20 of the Prudential Standard SPS 250, dated 1 July 2022. The article requires attribution of any status to a life insurance beneficiary to be fair and reasonable.

The proposed requirement signals an endeavour by APRA to improve insurance outcomes for members who may not be eligible for the full product. The requirement is understood to be APRA’s response to ASIC Report 633¹, which critically assessed the consumer outcomes of the Activities of Daily Living TPD definitions.

The purpose of this document is to assist the Trustee in demonstrating steps taken to ensure fair and reasonable provision of premiums and benefits to members. Specifically, this note considers some examples in relation to this requirement; and advises some documentation rules to the Trustee.

Insurance Status

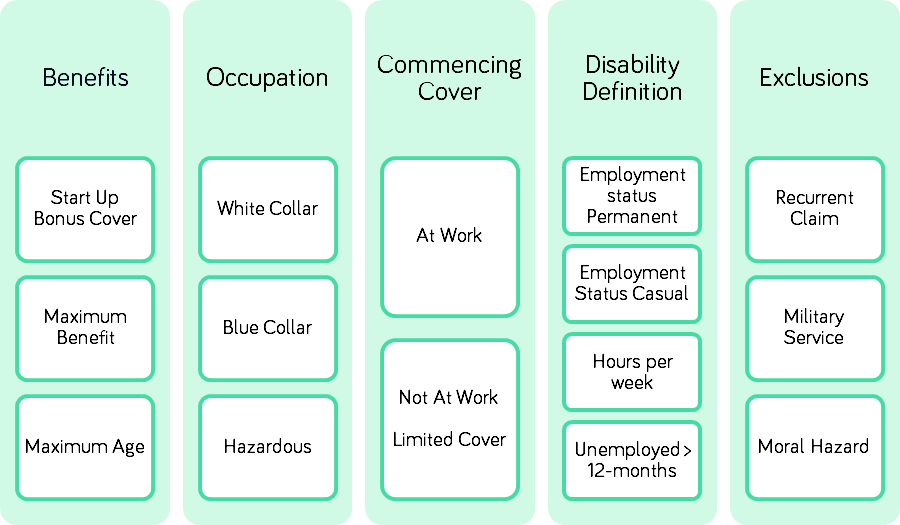

Insurance products inside superannuation contain many instances of status attribution² Some examples of this are shown as follows

The above-mentioned categories are cohort divisions, which may result in differential treatment for members, with respect to premiums or benefits.

SPS 250 requires an RSE Licensee to be able to successfully demonstrate a fair and reasonable attribution of these statuses.

Best-practice may be for the RSE Licensee to have an actuarial report, which examines such attributions in context of historical claims experience or other sources of data. For instance, in the case of ADL definitions being offered to members unemployed over 16 months, the report may make references to:

-

the group of members posing a high risk of claim, which may put pressure on portfolio pricing;

-

the inability to identify suitable occupation the member can perform based on education, training or experience; and

-

the benefits reflecting a financial hazard risk for the member.

The report may also make mention of Value measures such as Pricing Loss Ratios

Recommended Documentation

The following table outlines some examples of justifying fair and reasonable attribution of status to members

| Category | Description |

| Occupation |

|

| Limited Cover if not “At Work” |

|

| Disability Definition by Employment Status |

|

Conclusion

Article 20 in the SPS 250 requires Trustees to have an informed view on fair and reasonable outcomes for various sub-groups within the insurance portfolio. The Trustees can successfully achieve this by preparation of an actuarial report, which sets out evidence-based reasoning for various classifications and controls built into the insurance product. Such controls ensure the right balance of pricing and benefits across the membership.

Footnote

¹ ASIC Report 633 “Holes in the safety net: A review of TPD insurance claims” (REP 633)

² A status assigned to a member under a life insurance policy, e.g. ‘smoker status’, ‘blue collar’, ‘white collar’, etc