- May 9, 2023

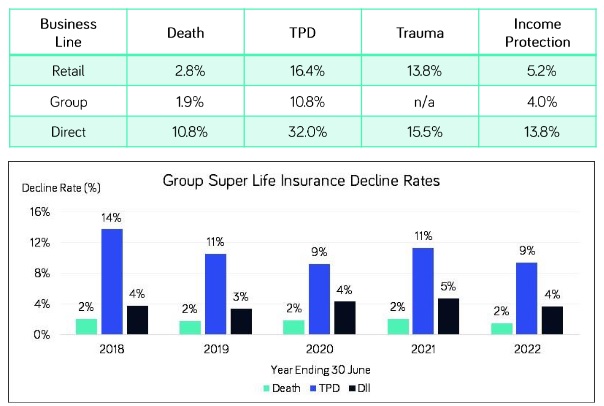

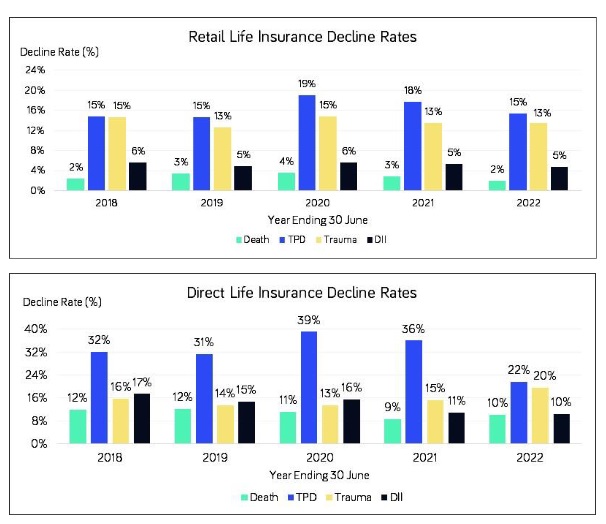

Life Insurance - Decline Rates

Azuria has performed analysis on the life insurance industry’s claim decline rates using half yearly APRA Life Insurance Claims and Dispute Statistics.

The time series for most product lines shows stability in the decline rates. TPD decline rate for Group Business has stabilised at a lower level around 10% post Financial Services Royal Commission in 2018

The following table shows the average decline rates by benefit and business line for 5 years ending June 2022

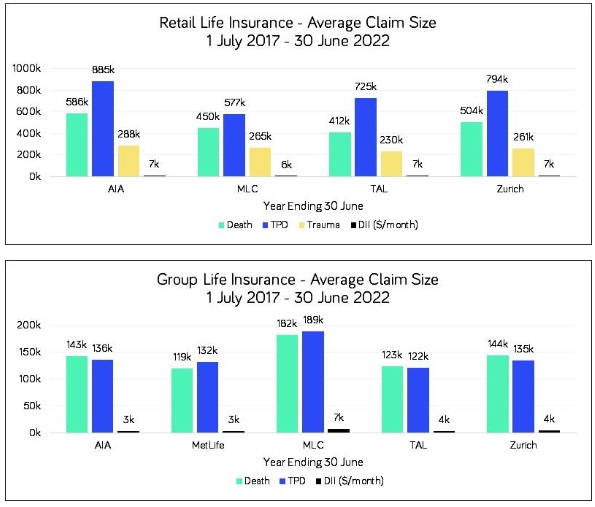

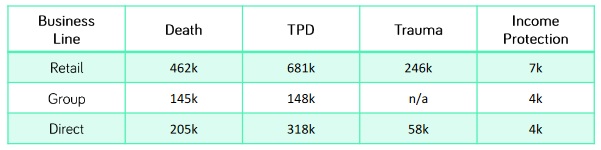

Life Insurance – Average Claim Size

Azuria has performed analysis on the life insurance industry’s claim decline rates using half yearly APRA Life Insurance Claims and Dispute Statistics.

The following table shows the average claim size by benefit and business line for 5 years ending June 2022

This analysis illustrates the wide difference between average claim sizes for Retail and Group business.

On average, the TPD Claim Size for Group business can be approximately 22% of the average claim size for Retail business.

This is largely driven by customers who receive financial advice, being more aware of their cover needs. Customers obtaining cover through their superannuation fund, may receive default cover, which is lower due to the absence of underwriting.