- March 23, 2023

Azuria Partners Research Note: Getting ready for Draft SPS250

Damian Thornley, FIAA, BBQ enthusiast and Partner | Azuria Partners.

1st March 2021

Introduction

It’s been a busy start to the year for the regulation of Insurance in Superannuation, with APRA releasing a second draft prudential standard for SPS250, and an updated version of the prudential practice guide SPG250. These have been released for a further round of consultation due March 7th. APRA intends to finalise SPS250 and SPG250 by mid-2021 with the finalised standard expected to commence from 1 January 2022.

APRA’s review of SPS250 arose from specific recommendations from the Royal Commission into Financial Services. APRA’s proposed amendments to SPS250 have also been shaped by discussion on the efficiency of the superannuation system and MySuper products (led by ASIC, Productivity Commission), and the Government’s push to increase Superannuation accountability and transparency (“Your Future, Your Super”, released in Budget 2020-21). Continuing community debate exists around the scheduled increase of SG contributions.

This Azuria Partners Research Note focuses on key areas of insurance arrangements that have received increased attention and scrutiny under draft SPS250. We present a brief overview of key potential changes to be aware of, particularly for RSE licensees and practitioners of Insurance in Superannuation.

Key Summary

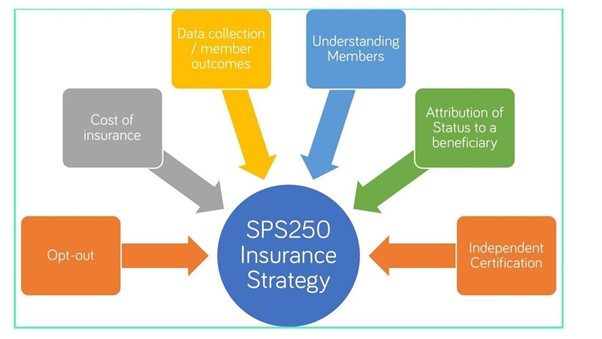

The diagram below illustrates a selection of new concepts arising from draft SPS250. Key updates include requirements upon RSE Licensee to understand their membership, and to ensure that the insurance strategy is appropriately designed for the various membership cohorts.

Key New Themes for Draft SPS250

| Topic Area | Key Themes and focus |

| Opt-Out | Recommendation from the Financial Services Royal Commission to make it easier for Members to understand how they can opt-out of insurance, and to educate Members on the benefits and consequences of doing so. |

| Cost of insurance and erosion of member account balances. | Draft SPS250 (Para16) now explicitly states that the insurance strategy requires the RSE licensee to document the methodology used to determine whether the cost of insurance inappropriately erodes the retirement income of beneficiaries. |

| Data collection and monitoring of member outcomes | On page 10 of the PPG, APRA recommends an extensive list of data points that should be collated by the RSE licensee including:

|

| Understanding Members | Monitoring of the insurance strategy requires the RSE licensee to have a comprehensive understanding of all their different membership groups. Trustees will need to be able to identify different cohorts of members within the default strategy, including differences due to:

|

| Attribution of status to a beneficiary | RSE licensee has to be able to demonstrate that any rules for attributing a particular status to a beneficiary, cohort or class of beneficiaries, are fair and reasonable. |

| Independent Certification | A new requirement – where insurance is with a related-party entity, or where the insurance arrangement confers ‘priority or privilege’ to an insurer, then an independent certification needs to be obtained that attests: “it is reasona6le for the PSELicensee to form that view that the insurance arrangement is in the best interests oTthe beneficiaries.” |

Key Implications

Increased compliance requirements for RSE Licensees.

The increased responsibility to understand membership demographics and cohorts connects to new requirements covered elsewhere in the draft SPS250, that require the RSE licensee to ensure that the rules by which a member are attributed to a particular status are fair and reasonable.

Rules for attribution of a particular status to a beneficiary

The Draft PPG suggests examples linked to categories used to classify different premium rate levels, but I would suggest that this would also cover situations where an insurance policy attributes a different type of claim definition or benefit treatment to different cohorts of members. For example, a status attributed to a cohort of members could be interpreted as “members unemployed for longer than 6-months” for the purpose of a claim definition.

Importantly, such distinctions and attributions now require the RSE licensee to ensure that any type of discriminatory policy rules based on attributions of a particular status “. are based on statistically

appropriate data.” This will place a requirement on RSE licensees and life insurers that wish to draw distinctions between the claims experience results for various membership cohorts, that they can analyse and measure such outcomes.

Independent Certification

Trustees will have to give consideration to arrangements that may be viewed as conferring ‘priority or privilege’. Some examples are discussed in the Draft PPG, but these will be by no means exhaustive.

Conclusions/Thoughts for how Life Insurers can assist Superannuation Trustees

In summary, draft SPS250 requires RSE Licensees to demonstrate a detailed understanding of their members and the differing insurance needs of various sub-divisions of the insured membership.

Trustees will need to understand implications to membership groups to justify the strategy for providing the insurance default arrangements that are selected, and document how they determined that this default level of insurance does not unreasonably erode account balances.

Opportunities exist for life insurers to provide detailed actuarial and data analytics support to their superannuation partners to assist with:

- Re-evaluating parts of the policy that may have product features that lead to some cross- subsidies between claims versus premiums in member outcomes.

-

Supporting RSE licensees to identify member segments and develop solutions to update existing policies.

-

Understanding Members: assisting in operational improvements to capture relevant member information to perform better data analysis to allow RSE licensees to understand their members better, and to manage emerging risk from providing insurance covers to members.

Contact Azuria Partners if you’d like to discuss any further aspects of draft SPS250 with us.