- March 23, 2023

Insurance Stapling - Key Opportunities and Threats for Life Insurers - A strategic perspective *

“Your Future, Your Super” (YFYS) legislation, which commenced on 1 July 2021, introduced broad-ranging changes to the superannuation landscape, including stapling of member accounts for insurance. Stapling means that a person’s superannuation account will follow them as they change jobs, unless they actively opt for another fund. This article highlights key strategic implications for life insurers, including opportunities to improve and threats to address.

Opportunities

1. Identifying and solving for cross-subsidies

In an emerging YFYS landscape with fewer funds, the potential risks associated with insurance cross-subsidies could be more easily exposed as members are encouraged to “compare the pair”. Such cross-subsidies will act as a risk to the fund if they induce members to switch fund for reasons that are not sustainably underpinned by rational insurance pricing factors.

-

Key risk that members who do not fit the average customer profile of a fund will be subject to greater cross-subsidisation.

-

Traditionally, industry funds specialised in targeting customers in specific occupation or industry sectors.

-

Insurance product design and cross-subsidy decisions have been shaped around the fund’s customer demographic, often heavily influenced by occupational makeup and age.

-

There will always be a degree of cross-subsidisation in insurance, though YFYS changes may intensify the impact on members.

-

-

Funds that receive a higher proportion of younger Members joining may see a higher concentration of other occupations in the future as these members change occupation but remain in the fund.

2. Assisting trustees with group insurance product changes

Trustees will require additional support as funds respond to ‘universal terms’ type changes. An example of this is the ongoing consideration and implementation of product changes that arise from regulatory reform pressures.

-

A product landscape with fewer sizeable Funds could see a trend within group insurance towards convergence of product terms.

-

Driving forces have been regulatory review of product terms of pressure to reduce the complexity of products.

-

Some examples are shown in the table below.

-

Table: Potential future product convergence

|

Potential change |

Likelihood |

Impact |

Comment |

|

|

Activities of Daily Living TPD definition |

Reduce usage |

Medium – High |

Medium |

Could create new cross-subsidies |

| TPD definitions |

Universal definition Regulators prefer consistency and easy of comparison |

Low – Medium |

High |

Disruptive and create risks to claims experience |

| Cover commencement |

Standardisation of ‘At Work’ and cover commencement Changes to AAL |

Medium |

Medium |

3. Simplifying the insurance product design

Trustees will require additional support as funds respond to ‘universal terms’ type changes. An example of this is the ongoing consideration and implementation of product changes that arise from regulatory reform pressures.

-

A product landscape with fewer sizeable Funds could see a trend within group insurance towards convergence of product terms.

-

Driving forces have been regulatory review of product terms of pressure to reduce the complexity of products.

-

Some examples are shown in the table below.

-

Table: Potential future product convergence

Cost and efficiency forces may lean towards an insurance design where it’s better to create a distinction between a base product and optional top-up benefits.

-

Traditionally, the Trustee’s decision on insurance product design (size of benefit and product choice) has been shaped by member occupation or industry sector. With the introduction of insurance stapling, this approach may need to be revisited.

-

Opportunity to develop a more deep-rooted relationship with customers.

-

Differentiate the purpose of group insurance from one focused on providing basic insurance needs to one where top-up benefits may be more attractive.

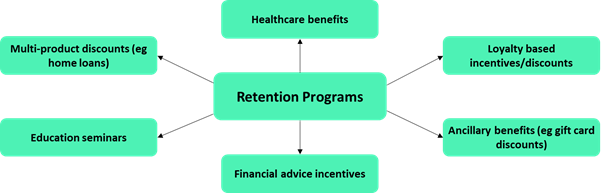

4. Proactive customer and insurer engagement

Long term membership of the same fund means that customer stickiness and insurer engagement become important. The strategic imperative for Funds to differentiate their offering could create increased emphasis on ‘member reward’ type programmes. Insurers that are able to differentiate their service with unique offerings to assist the Fund may be preferred in a competitive landscape.

Diagram: Customer retention and engagement programs

Threats

5. AAL limits for tailored corporate super plans

Checking and reviewing the AAL for tailored corporate super plans where the proportion of the newly commencing employees that are joining the Fund’s corporate super plan is decreasing. High AAL’s could present a risk to the Life Insurer where the proportion of new entrants is reduced.

6. Stapling and mega-fund consolidation

The dynamics of the superannuation system are shifting, with a smaller number of large schemes focused on the efficiency and cost of delivering superannuation. If the cost of insurance becomes captured within the mandate of the YFYS performance test, this would place downwards pressure on the insurance premium. In any case, with fewer Super Funds expected to be in the emerging YFYS landscape, tools that enable increased comparability of the Life Insurance offerings could be more easily created by regulators or consumer advocates.

-

Commoditisation of insurance would lead to focus on price, rather than other factors such as customer experience, underwriting, claims, etc.

-

Scenario testing for large funds based on fund membership

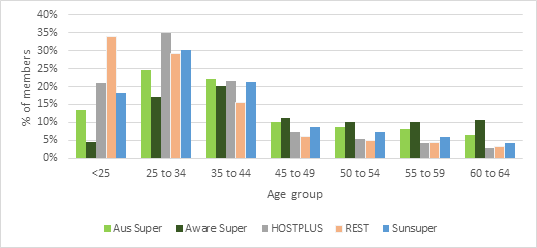

Chart: Age demographic profile of top 5 industry super funds