- May 9, 2023

Premium Rate Comparison - Long Term Income Protection

Damian Thornley

April 2023

Azuria Partners have conducted a comparison of the cost of purchasing long-term income protection benefits from four major superannuation funds in Australia.

Income Protection To-Age 65 Benefits

Long term income protection means that insurance benefits in relation to disability can be paid until the claimant reaches age 65. To-Age 65 income protection is an expensive life insurance benefit and its role has continued to diminish within the default insurance product suite.

This product is usually offered as a voluntary benefit by superannuation funds, or occasionally may exist as a legacy benefit for an existing group of members. It may be reasonably expected that the cross-section of fund membership that wish to voluntarily select such a benefit is broadly comparable across each of these major funds. For instance, the occupational profiles of members voluntarily purchasing this benefit may be comparable across different superannuation funds.

The pricing of income protection contracts with long-term benefit period is among the riskiest of the life insurance benefits, as there is a significant probability that claims experience can deviate materially from the underlying claims assumptions. The pricing of this benefit needs to ensure that the funding of such products adequately reflects the risk of offering such benefits.

Funding is usually provided by the life insurer shareholders but could also be provided by members themselves (indirectly) such as within the umbrella of a Premium Adjustment Mechanism (PAM) arrangement.

Analysis Overview

A-priori hypothesis is to expect a close comparability between the varying premium rates offered for this benefit type, because the risk characteristics of the product and the applicant member profile would be expected to be similar across all superannuation funds.

This Report may be of interest to superannuation funds and also to life insurance organisations who may wish to benchmark the risk of offering such a product with other providers.

The data used in the study is based on the Insurance Guides of four major superannuation funds, as at April-2023. These are Australian Super, Australian Retirement Trust, Hostplus & HESTA. The superannuation funds included in the survey represent approximately 6.8 million members and therefore, represent a large proportion of the Australian population.

Observations

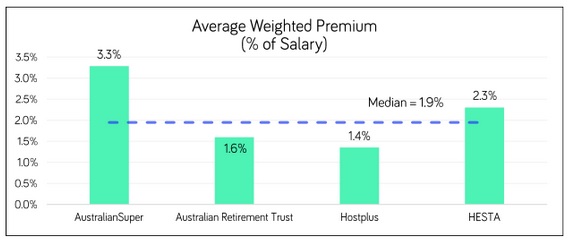

- Across the four products analysed, the median premium rate offer is 2% of salary.

- Australian Super offers a premium rate which is approximately 50% higher than the median.

- The other Funds are within +/- 30% of the median.

Conclusion

This report investigates premium rates for long-term income protection cover through four major superannuation funds. The expected result was for the premium rates to be reasonably comparable across major funds.

The outcome of the investigation suggests that there are sizeable disparities in the premium rate level offer.

As long-term income protection is amongst the riskiest of benefits, this report recommends the insurer and funds to potentially consider the harmonising of premium rates on offer.

For any questions about this research, please feel free to contact Damian Thornley on 0402 803 900 or [email protected]