- March 8, 2023

Re-imagining Group Income Protection to optimise customer affordability *

Introduction

In light of APRA’s move to improve the sustainability of individual IP, there is a wider opportunity to revisit the Group Income Protection product and ask whether the current product is affordable for policyholders. Comparing our Australian product design to other Income Protection products globally, overseas product designs favour affordability as a higher priority than benefit generosity.

How do overseas models compare to the Australian model and how can the Group Income Protection model be improved?

Global GSC models favour affordability relative to the Australian GSC model

The Institute of Actuaries commissioned a report to compare Australian GSC products with those in UK, USA and South Africa (published in Jan 2020)¹, with a number of key differences highlighting the generosity of the Australian definition. In particular, Australia has the most generous product features for:

-

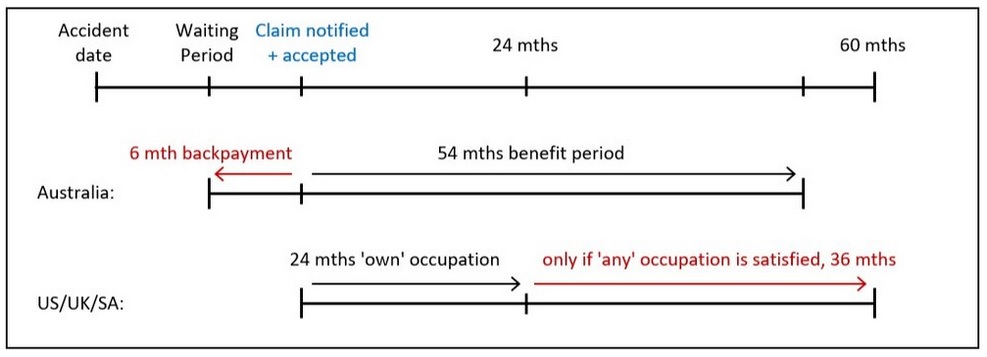

Disability definition (any/own): Australian GSC definition does not change over the duration of claim. In the UK and South Africa, the definition changes to any occupation after 24 months of claim.

-

Benefit period: Australian GSC allows the retrospective backpayment of claims after notification. However, products in the UK, US and South Africa require that the claim only be payable as a ‘managed claim’ after the claim is notified.

-

Replacement ratio: Payments limited to 85% of policyholder income in Australia, compared to the lower limit of 70-80% in comparison countries.

Diagram 1: Timeline comparing the benefit period for Australia compared to other countries, based on a GSC policy with 6 month waiting period, 5 year benefit period

Re-imagining Australian GSC product design

Great care is needed though when exploring changes to benefit design, as there may be material impacts to the livelihoods of future claimants. Nevertheless, it is worthwhile considering potential changes to GSC product design and the impact of such changes to claims cost (leading to premium reductions), with a focus on optimising affordability.

Product alterations and claims cost impact comparison

Product element | Impact on claims cost |

Replacement ratio reduced by 10% | Material reduction to claims cost |

Disability definition change to “any occupation” after 24 months on claim (instead of “own occupation”) | Modest reduction to 5-year IP product |

Back-payment removed and benefits are only payable as a managed claim from notification date (US/UK/SA method) | Slight reduction in claims costs (and reduction in claim duration) |

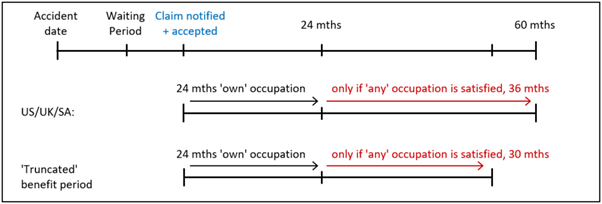

Back-payment removed, managed claim from notification date and benefit period shortened (‘truncated’ benefit period*) | Significant improvement to claims cost |

Total | Cost reductions of >20% |

* While improving premium affordability, a ‘truncated’ benefit period design needs to be considered through a “member best interest” lens (particularly member awareness of their insurance benefits in superannuation), as the product feature causes significant variation in claim duration outcomes.

Diagram 2: overseas and ‘truncated’ benefit period

Conclusion

Most of any increase in the GSC claims cost is ultimately borne by the non-claimant members of the insurance pool. In the current environment of higher benefit costs due to regulatory changes (PYS/PMIF) and other structural changes, we need to continue to review the GSC product to ensure that affordability is at the forefront of design considerations.

This Paper highlights the potential to modify Australian GSC product features to achieve material reductions in premium rates.

References

¹ “Disability Income: An International Comparison 2019”, https://www.actuaries.asn.au/Library/MediaAndPublicPolicy/2020/DIPaper03022020.pdf